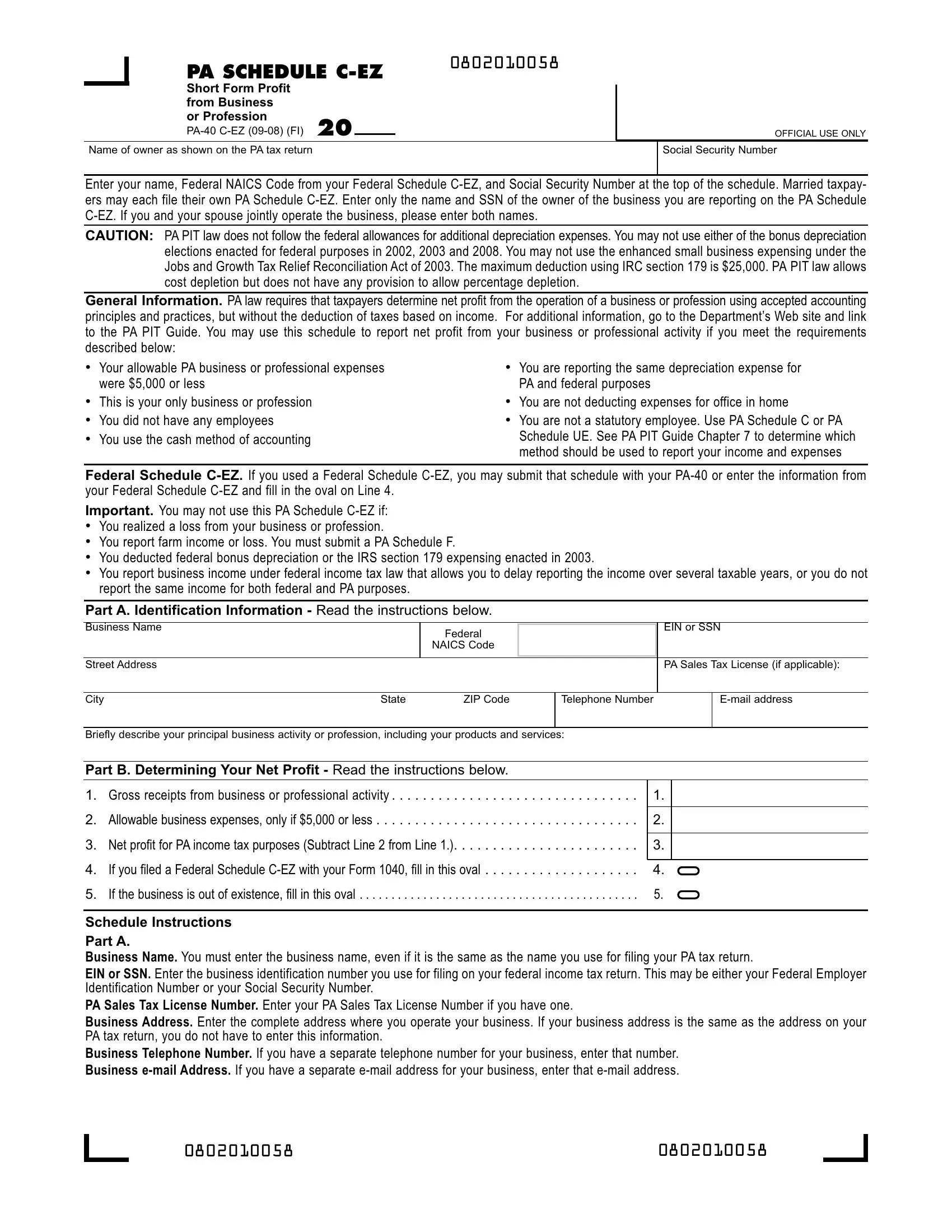

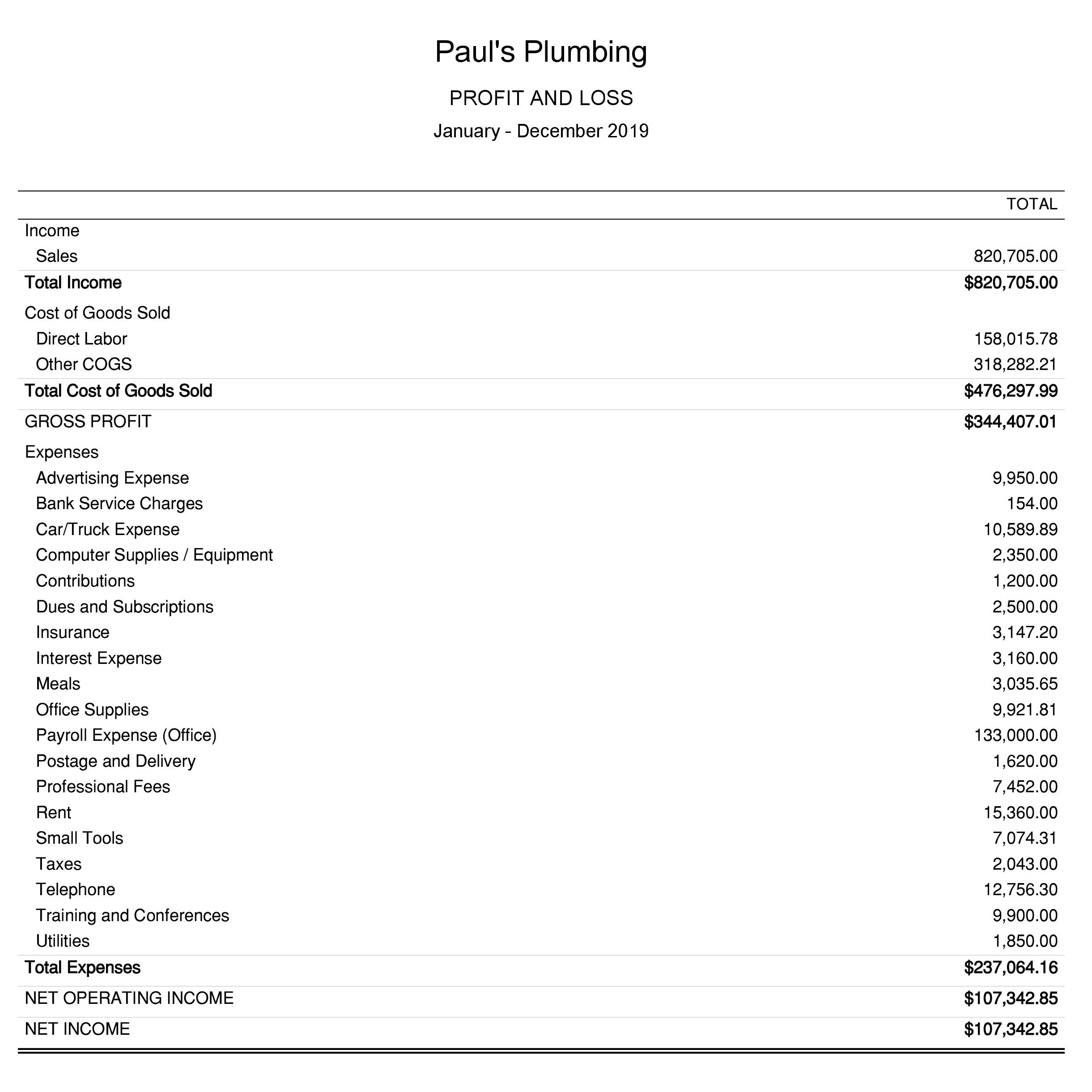

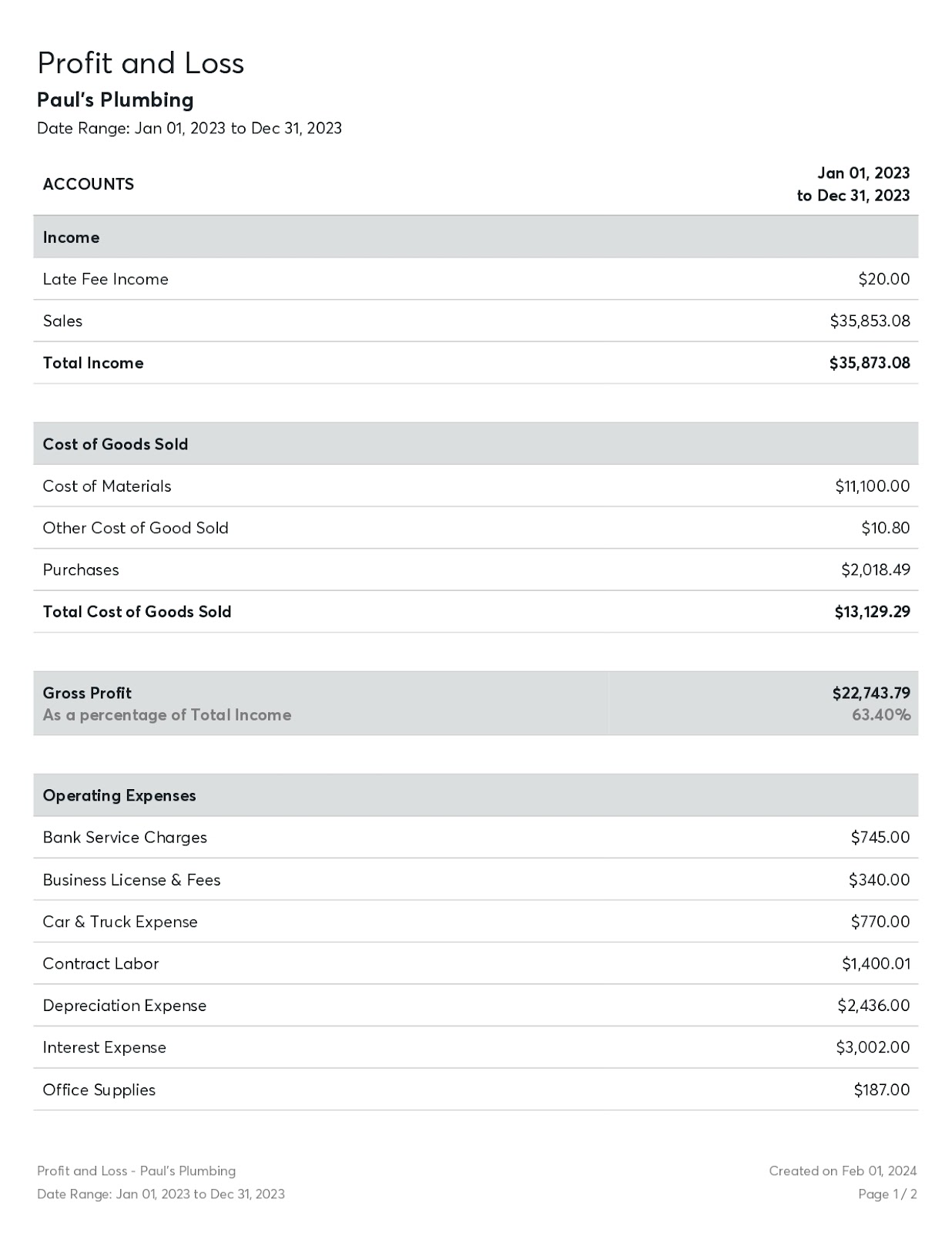

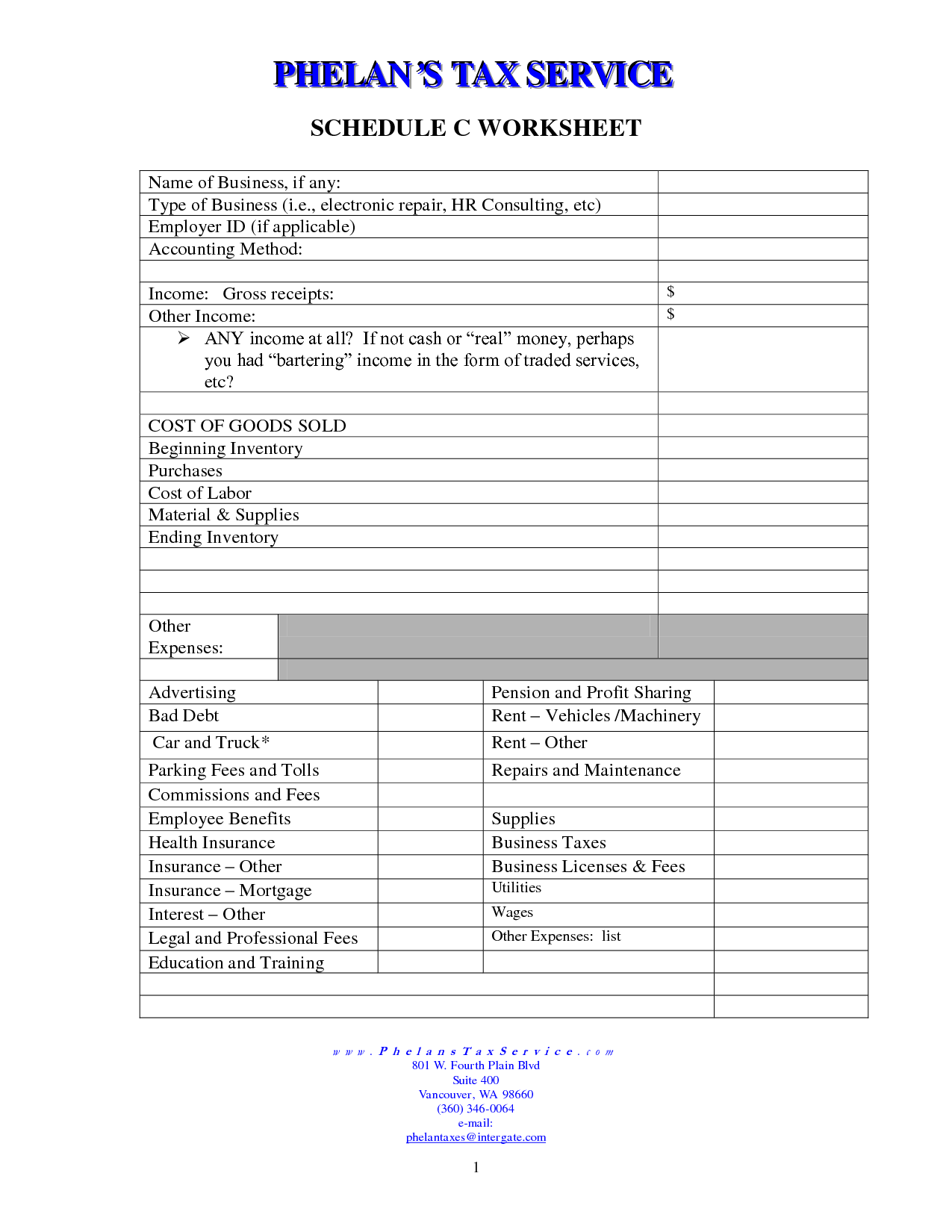

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Staunton Va Obits

- Clarksville Tn Mugshots

- Metra Milwaukee West Schedule

- Appointment With Chase Bank

- Hannah Statewins

- Visalia Times Delta Obituaries Last 30 Days

- La Fitness Hours Labor Day

- Female Crossdress

- Tibbs Nuestra Familia Stabbed

- Actress On Carshield Commercial

- Elmira Ny Breaking News

- Craigslist Jobs In Merced

- Metv Plus Tv Schedule

- Crime Map Albuquerque Nm

- Truckers Report Reviews

Trending Keywords

Recent Search

- Current Inmate List Tippecanoe County

- Special Edition Nexus

- Tye Ruotolo Bjj

- Obituaries Lancaster County Pa

- Cvs Tb Testing Cost

- Courierpostonline Obituaries

- Bible Verse Quote Spine Tattoos

- Jacksonville Times Union Obituaries

- City Boys Urban Dictionary

- Makeup Organizer Drawers

- Purdue Directory Search

- Hit And Run Reno Nv

- Nelson County Busted Newspaper

- Law And Order Extended Family Cast

- Unblocked Retro Bowl Poki

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)