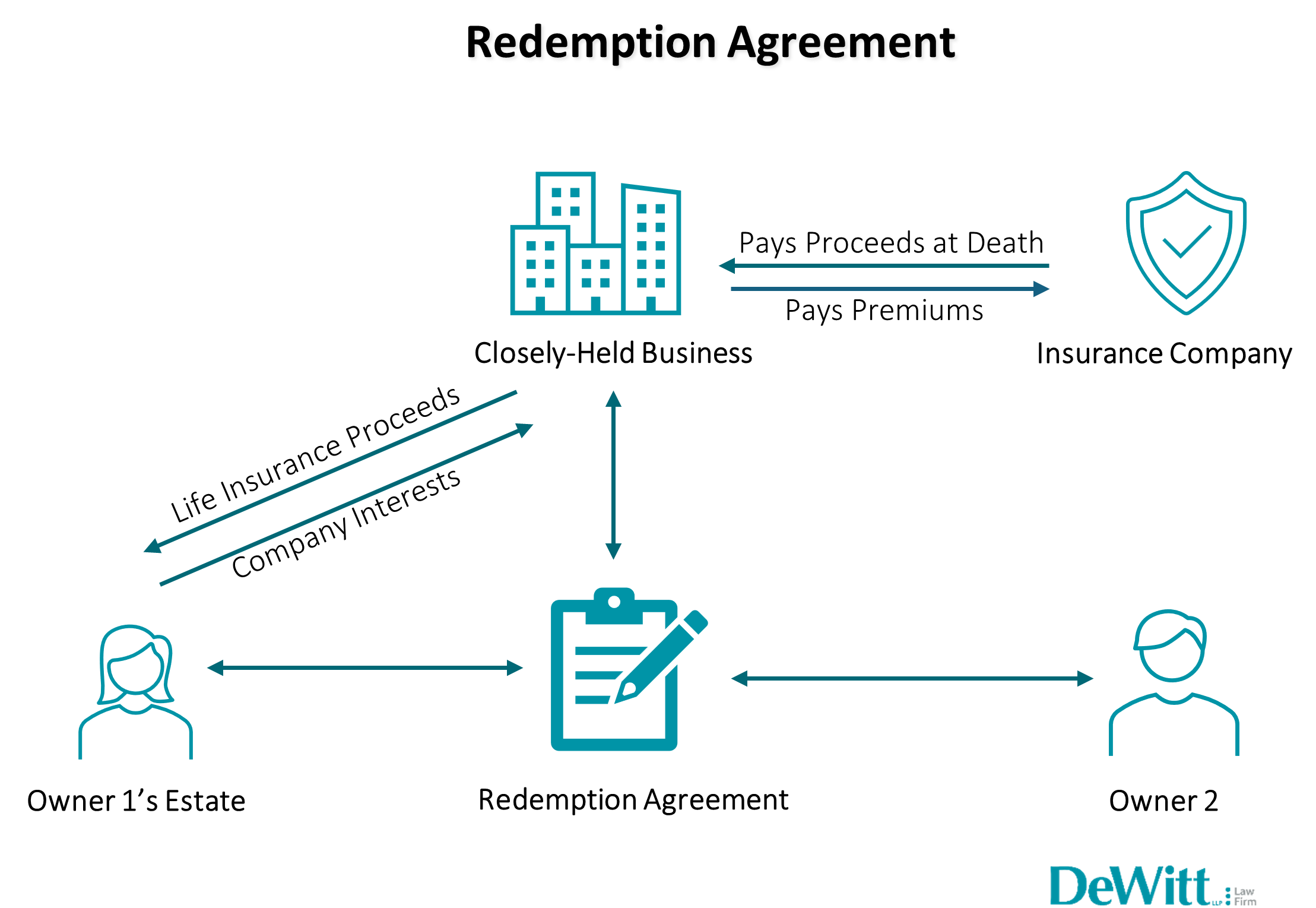

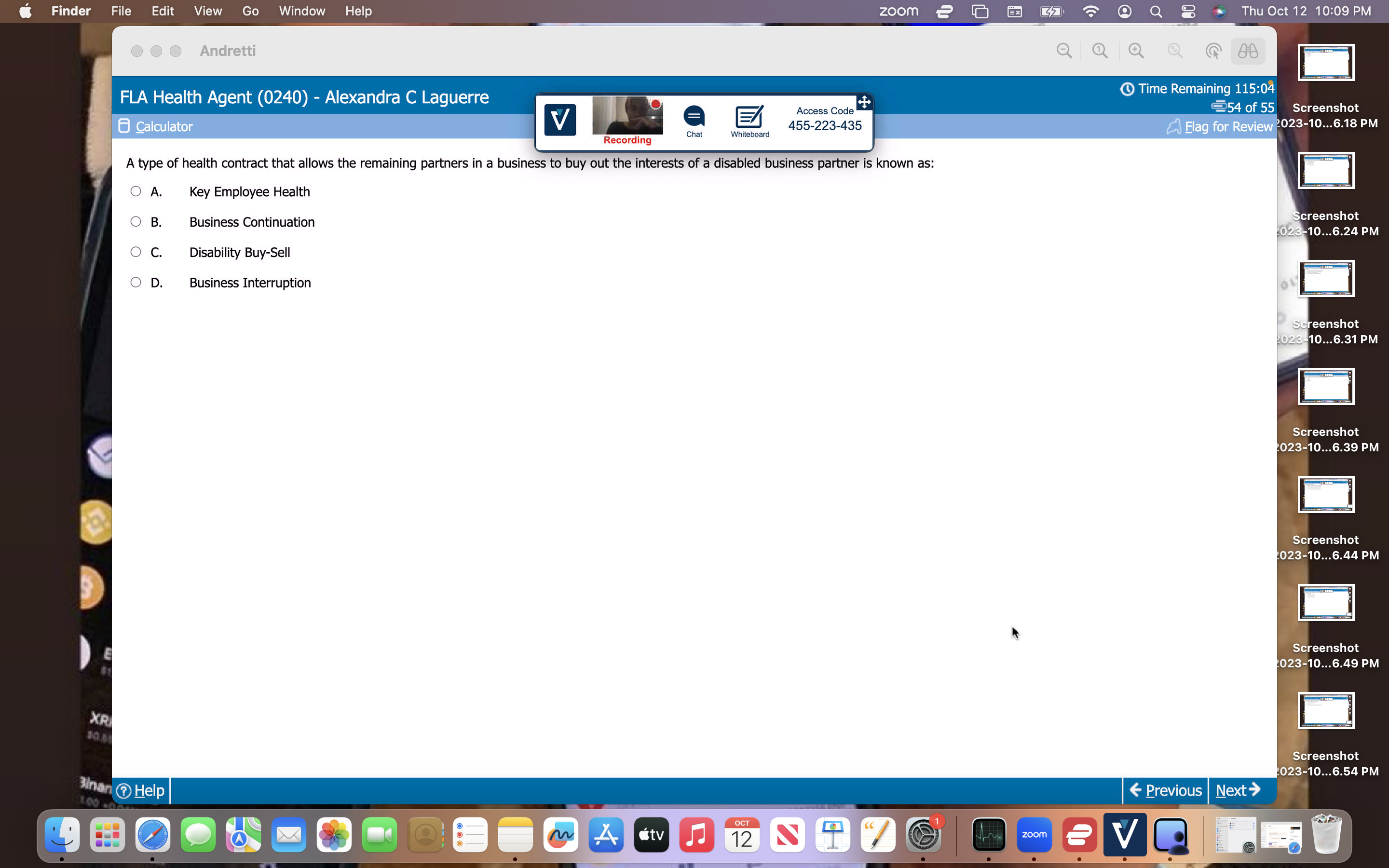

If the owner dies or becomes disabled, the policy would provide which of the. A policy owner would like to change the. With life insurance, the needs. Split dollar plan b. Benefits are taxable to the business entity b. Here’s the best way to solve it. Powered by chegg ai. View the full answer. A) the length of time a disability must last before the remaining partners can buy out the. Which of the following disability buy sell agreement is best suited for businesses with a limited number of partners. To ensure an orderly transfer of your business when you die; To set a value on the business for transfer and.

Related Posts

Recent Post

- Facebook Werewolf Story

- Anderson Laws And Jones Funeral Home Obituaries

- Best Knee Doctors In Philadelphia

- Northwell My Health

- Herscan Reviews

- Diy Push Handle For Wagon

- Sol Dispensary Jobs

- Data Entry Weekend Jobs

- T Mobile Downtown Brooklyn

- Vfs Global San Francisco Reviews

- Shroomok

- Rv Sales Jobs Near Me

- Kayak Tobacco Coupons

- Rheem Dealer Locator

- St Johns Mi Obituariespopup Modals Html

Trending Keywords

Recent Search

- Daly City Shooting Today

- Elijah Slaps Corey

- Sysco Drug Testing Policy

- Holiday Twin Radio Station

- Youtube John Hannah

- Joplin Globe Houses For Rent

- Vaccines Available At Cvs

- Cvs Employee Holidays 2022

- Houses For Rent 500 To 700 A Month In Glendale

- Studios For Rent In Trenton Nj

- Uw Staff Directory

- Valerie Parr Hill Son Gene Arm

- Alaska Airline Flight Attendant Salary

- Rcn Outage Chicago

- Spn 51 Fmi 2

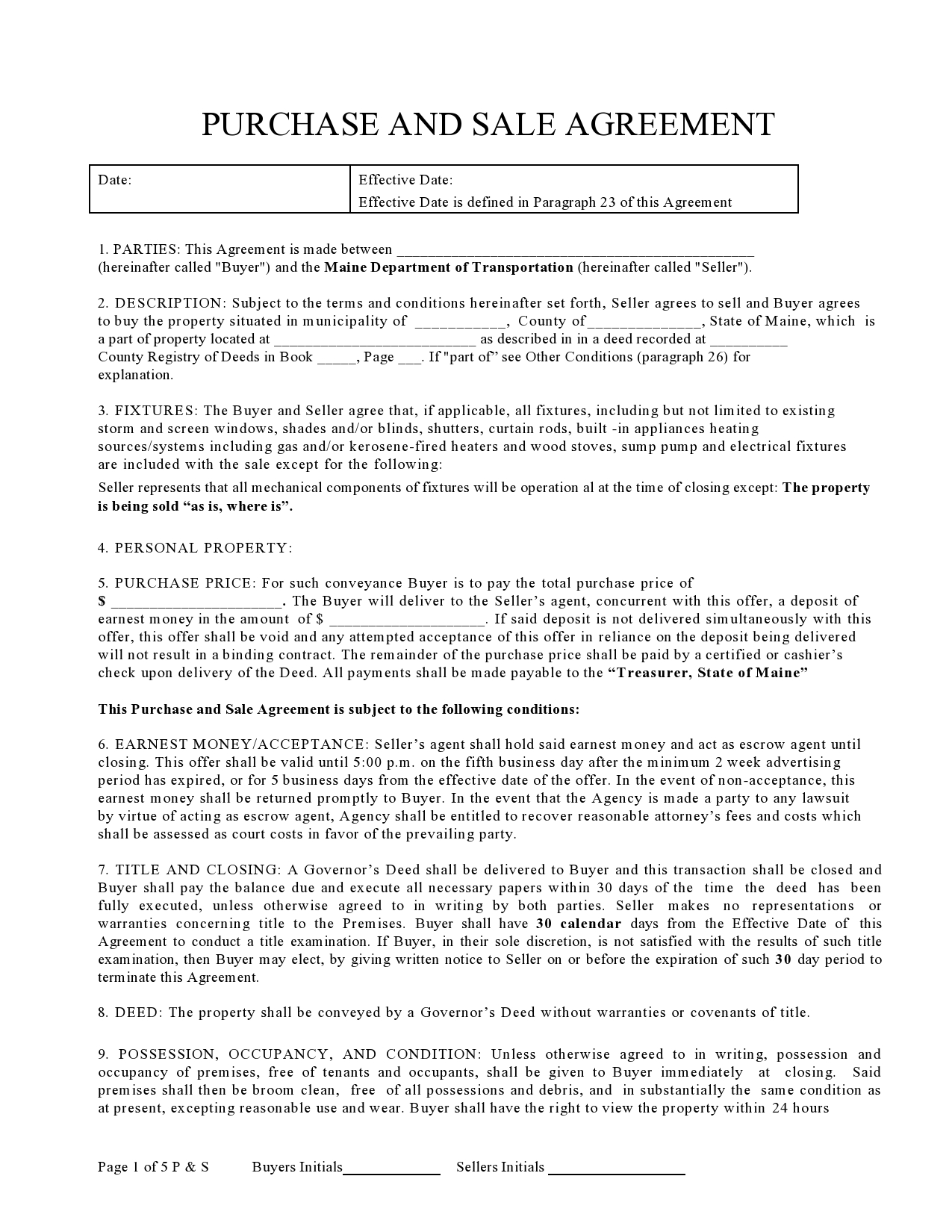

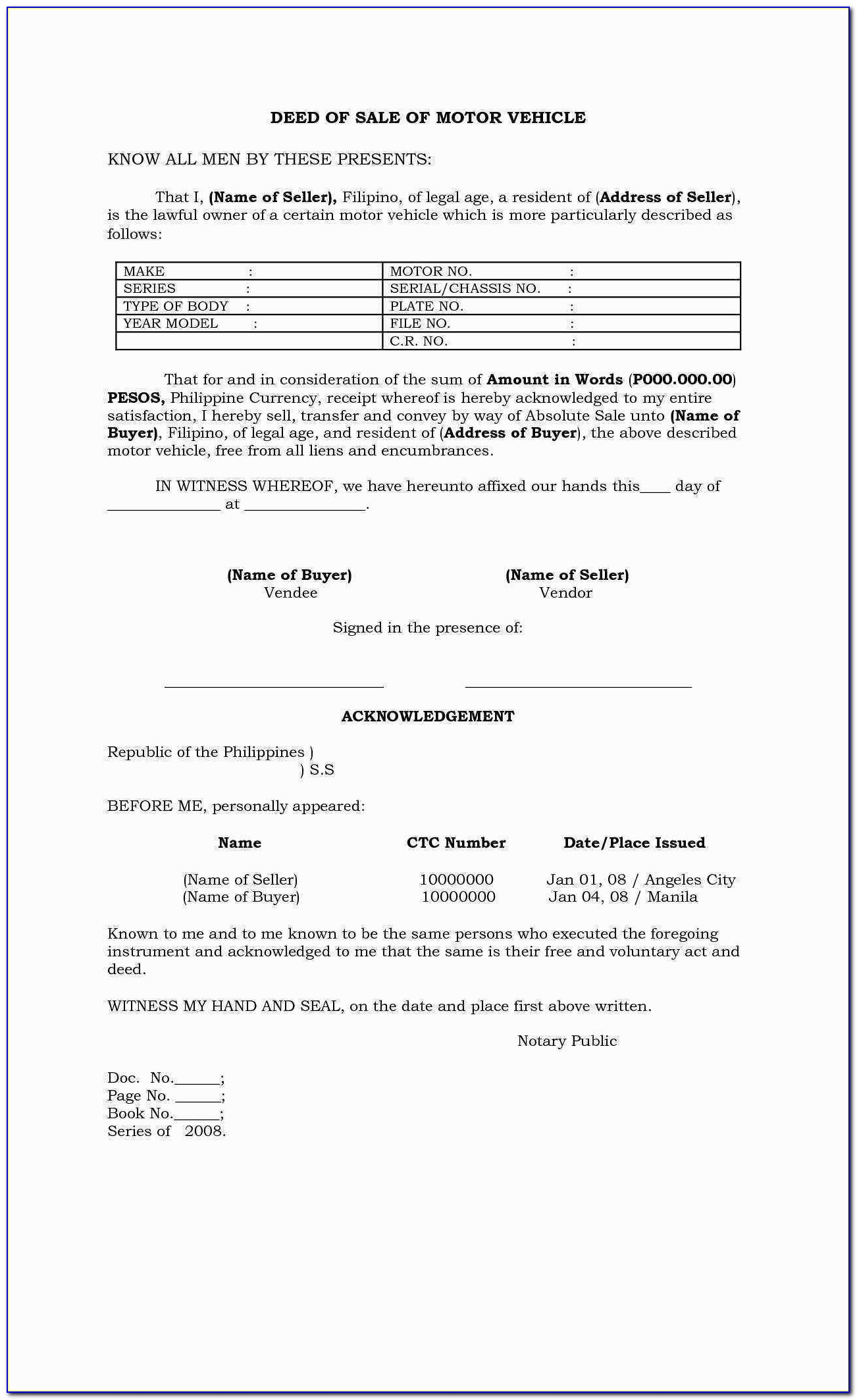

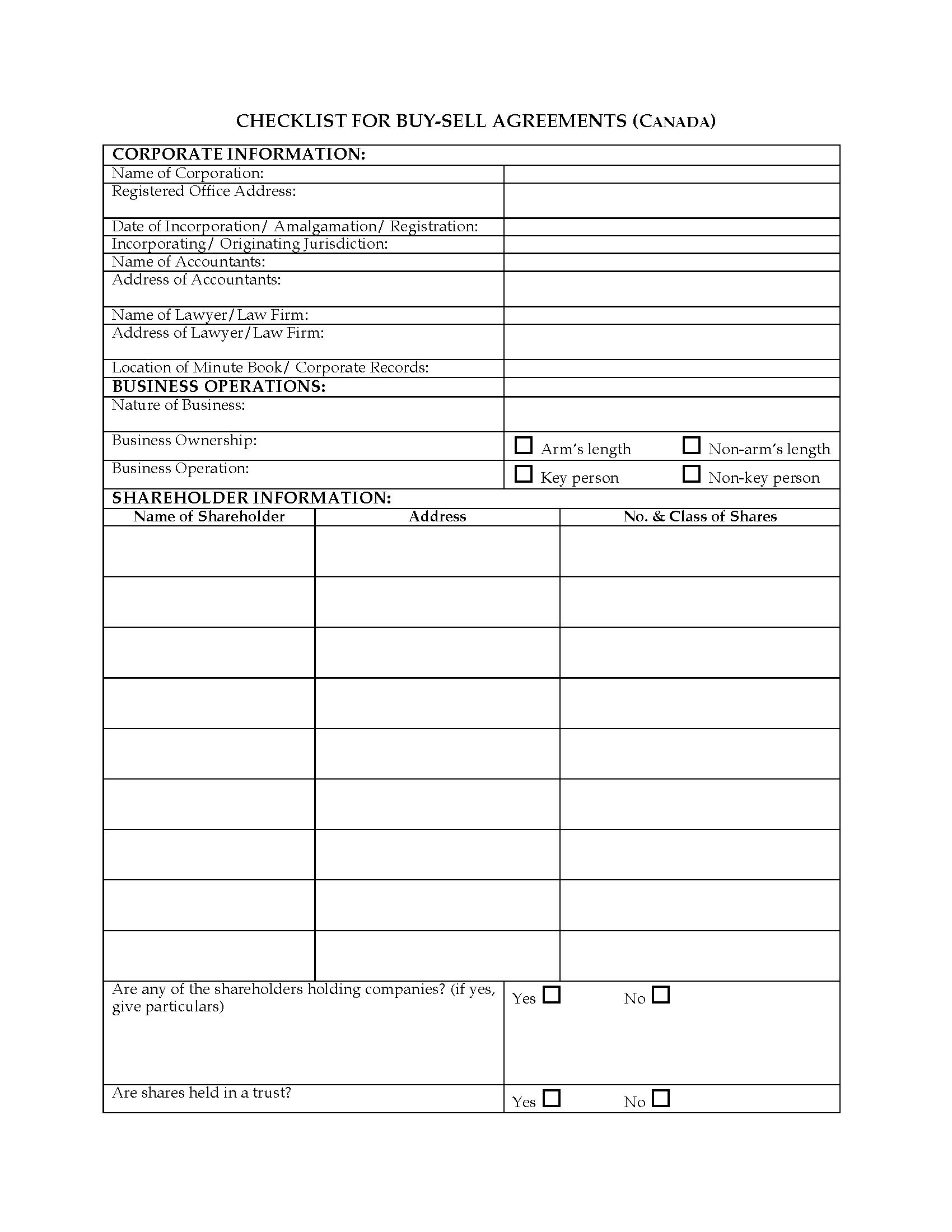

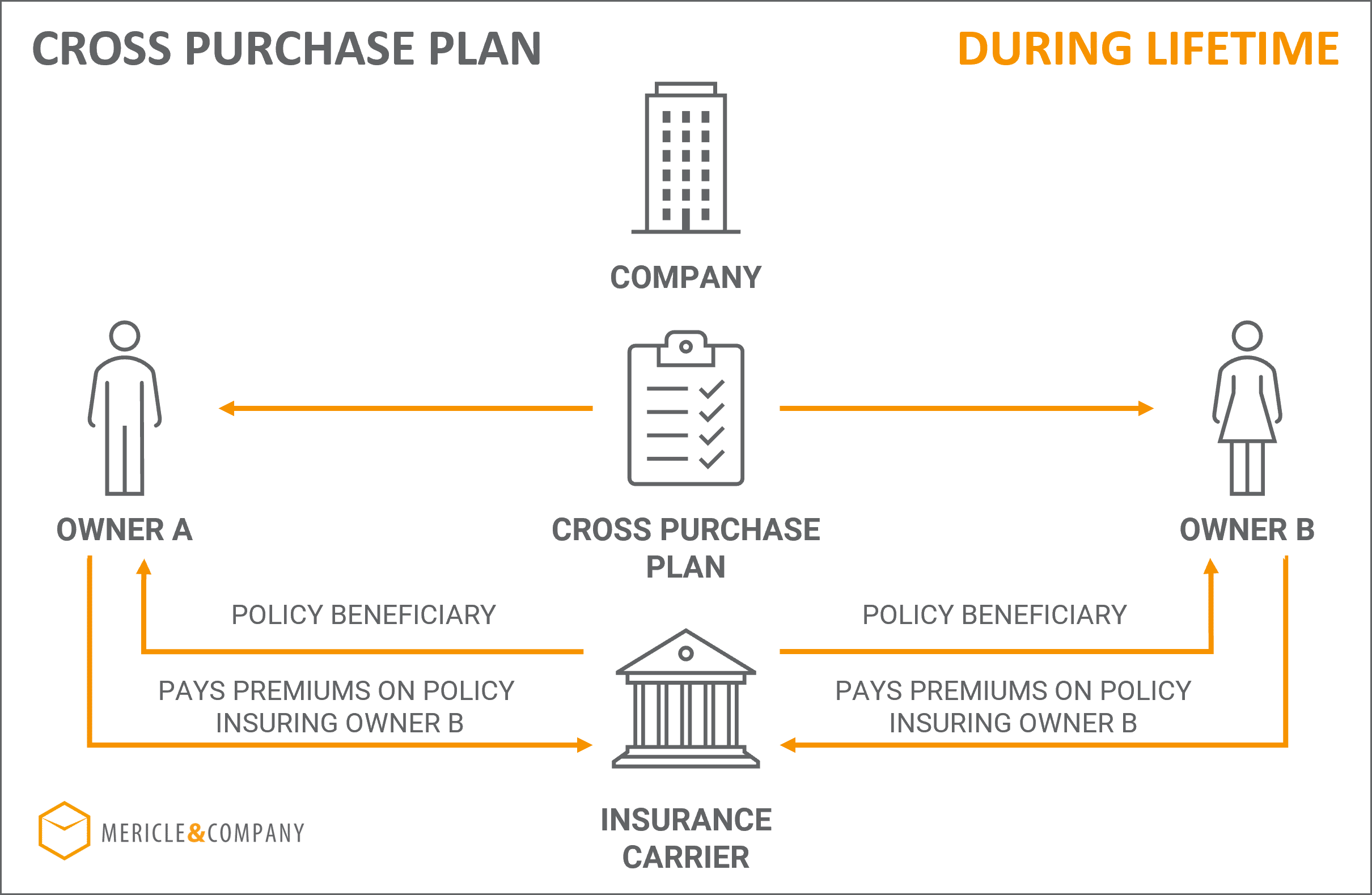

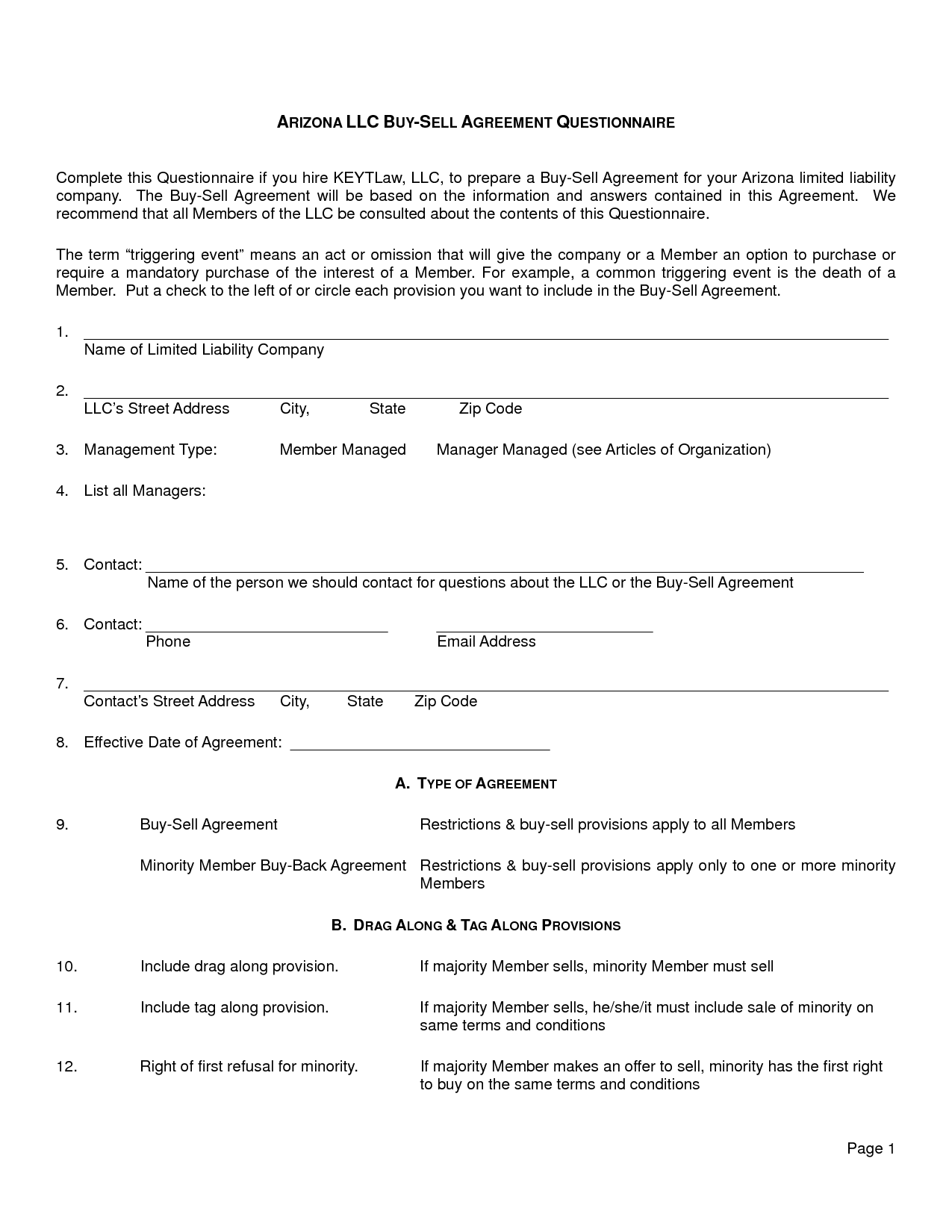

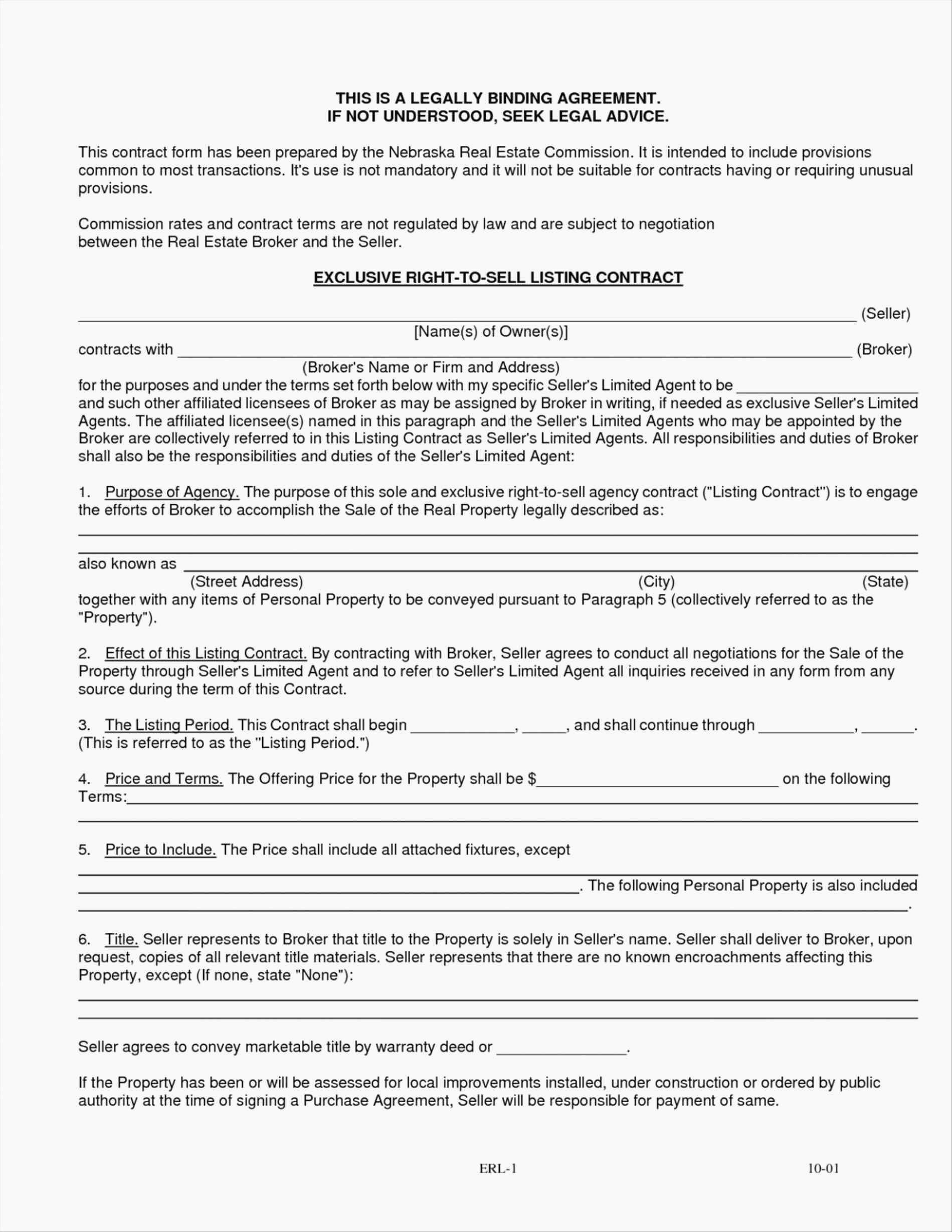

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-PDF-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Word-Document.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Template-of-Buy-Sell-Agreement-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Formatted-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Document-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Example.jpg)